Hi, I’m Richard. On this blog I share my thoughts, not investment advice. This is not a recommendation to buy or sell securities.

How to Start Investing in an Index ETF

By Richard Golian21 July 2024 Castellano Slovenčina

I have already written about my approach to money and how I began investing. I've also discussed the importance of time in investing and why starting as soon as possible is crucial due to compound interest. Now, I will describe how to start investing and what to watch out for.

Investing in Individual Shares vs. Stock Market Index ETF

I will not focus on investments in individual shares. For most people, this is an inappropriate form of investment. The smartest minds on the planet, along with sophisticated algorithms, are dedicated to it. It's like playing football against Messi—nonsense for most of us. It makes more sense to benefit from the fact that the stock market grows in the long term. That's what I will focus on today: profiting from the stock market's long-term growth by investing in the world stock index.

What is a Stock Index?

A stock index is like a summary of how a group of companies is performing. Instead of checking each company one by one, the index gives you a quick look at how the whole group is doing. If it’s going up, the group is doing well. If it’s going down, they’re having a tough time.

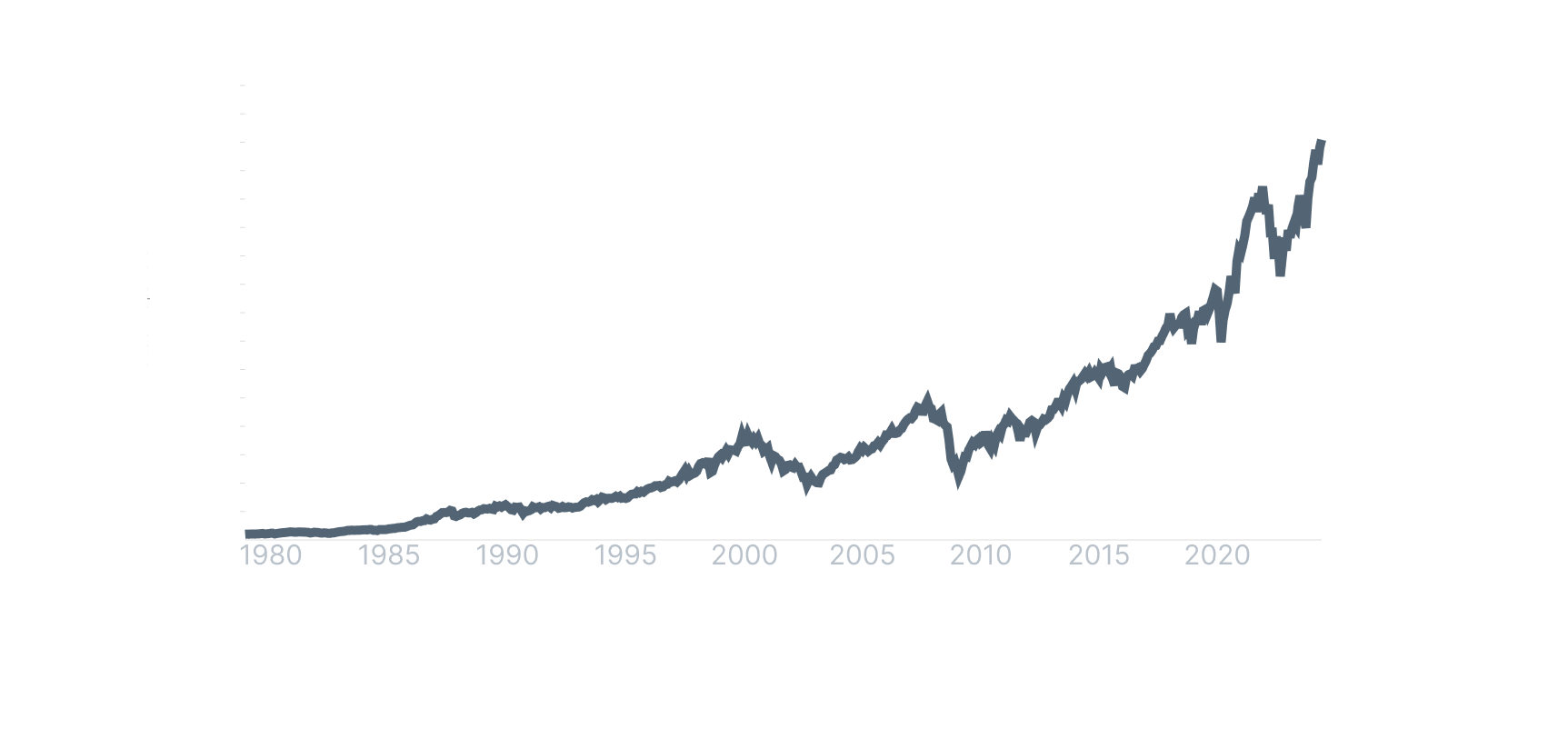

The Developed World Stock Index

The developed world stock index has an average annual growth of more than 10%. I explained what an annual compound interest of 10% means in my previous post. I recommend reading it; understanding this concept motivated me to invest. Knowing that the entire stock market of the developed world grows at more than 10% per year, investing becomes an absolute no-brainer for anyone who thinks even a little about the future.

How to Invest in the World Stock Index

The answer is through ETFs (Exchange-Traded Funds).

What is an Index ETF?

Think of an ETF as a mix of different investments all packaged together. When you buy a share, you get a part of everything in that package. An index ETF is a type of ETF that follows a particular stock index. It’s like buying a pre-made collection of all the stocks in that index, making investing easy and diversified.

Where Can I Buy an ETF?

You can buy ETFs through many intermediaries (brokers), but I would definitely prefer large, respected institutions. Personally, I only invest through banks, and I may write more about this in the future.

What to Watch Out For

When choosing a specific ETF, it's important to ensure, as with any intermediary (broker), that it comes from a large, respected institution. Here are other key considerations:

- Dividend Policy: Check whether the ETF pays out or reinvests the dividends from the companies in the ETF. Look for the term "distribution." I prefer ETFs that reinvest dividends (accumulative ETFs) due to tax benefits.

- Fees: Pay close attention to fees as they can vary greatly and significantly impact long-term profit.

- Replication Method: Ensure the ETF fund actually owns the shares of the given index. This can be found under the term "replication."

I consider also the size of the fund and other factors, which I will cover in future posts.

I recommend using ETF fund comparators like justETF. You can set the columns you are interested in for the funds there, such as those described above.

How to Start

The procedure is simple:

- Go to a respected institution that also acts as a broker.

- Get advice, but remember that bank employees work for the bank, not for you. Therefore, spend a few hours honestly investigating the fees and the ETF funds available at the institution.

- Once you have done the basic research, find the ticker (the identifier for the ETF at your broker) and proceed to buy.

Most people I know invest a smaller amount every month, a strategy known as dollar cost averaging. Another option is to invest larger sums at once. Both methods can be effective, depending on your fee structure, income, etc. I will write about my approach to this in the future.

I hope this post has helped you at least a little. I will continue writing about these topics, sharing my perspectives, steps, and thoughts on money. Remember, I do not offer specific investment advice. Always think for yourself and verify everything you read on the Internet or hear from your bank or investment broker.

Disclaimer:

This article is intended for informational and educational purposes only. It does not constitute financial advice, a recommendation to buy or sell any securities, or a guarantee of future market performance. The views expressed are solely those of the author, who may also be an investor. Investing in financial markets involves risk, and each reader should make their own decisions independently and, if necessary, consult with a licensed professional.

If you have any thoughts, questions, or feedback, feel free to drop me a message at mail@richardgolian.com.

269

269