Hi, I’m Richard. On this blog I share my thoughts, not investment advice. This is not a recommendation to buy or sell securities.

The Most Important Thing About Investing is to Start

By Richard Golian14 July 2024 Castellano Slovenčina

Mistakes and Lessons Learned

If I could go back to 2016, I would tell my younger self one thing: start investing immediately. I saved money for years but only began investing in 2022. In 2016, I didn't have enough information, I didn't know my options, and I didn't know how to start. No one taught me about investing at school or at home. I started studying this field in 2021 after seeing an interview with Radovan Vávra, a former director of a Czech bank. He explained how simple the math behind investing is, which was a big surprise to me. Even elementary school children could understand compound interest and a global stock index. It baffles me that these concepts aren't taught in Slovakia. Just show these two things in math class, calculate a simple example, and that's it! Our whole society could be richer.

The Basics of Investing: Compound Interest 10 %

Let me explain it as simply as possible. Imagine you have two piggy banks. Every month, you put $10 into each piggy bank.

Piggy Bank 1: No Interest

This piggy bank just keeps your money safe. Every month, you add $10. By the end of one year, you have saved $120. If you kept doing this from 1980 to 2024 (44 years), you would have saved $5,280.

Piggy Bank 2: With Interest

This piggy bank is special. It not only keeps your money safe but also gives you extra money every year for keeping your money there. This extra money is called "interest." Let's say this interest is 10% per year.

After the first month, you have $10. After the second month, you add another $10, making it $20. At the end of the first year, the piggy bank adds interest, so you get more, like $120 + 10% = $132. This keeps happening every year.

In subsequent years, the interest is calculated on the new total, which includes the previous year's interest. So, at the end of the second year, you have $132 + $120 = $252, and with 10% interest, it becomes $252 + 10% = $277.20. This process continues each year, with the interest being calculated on the new, larger total each time.

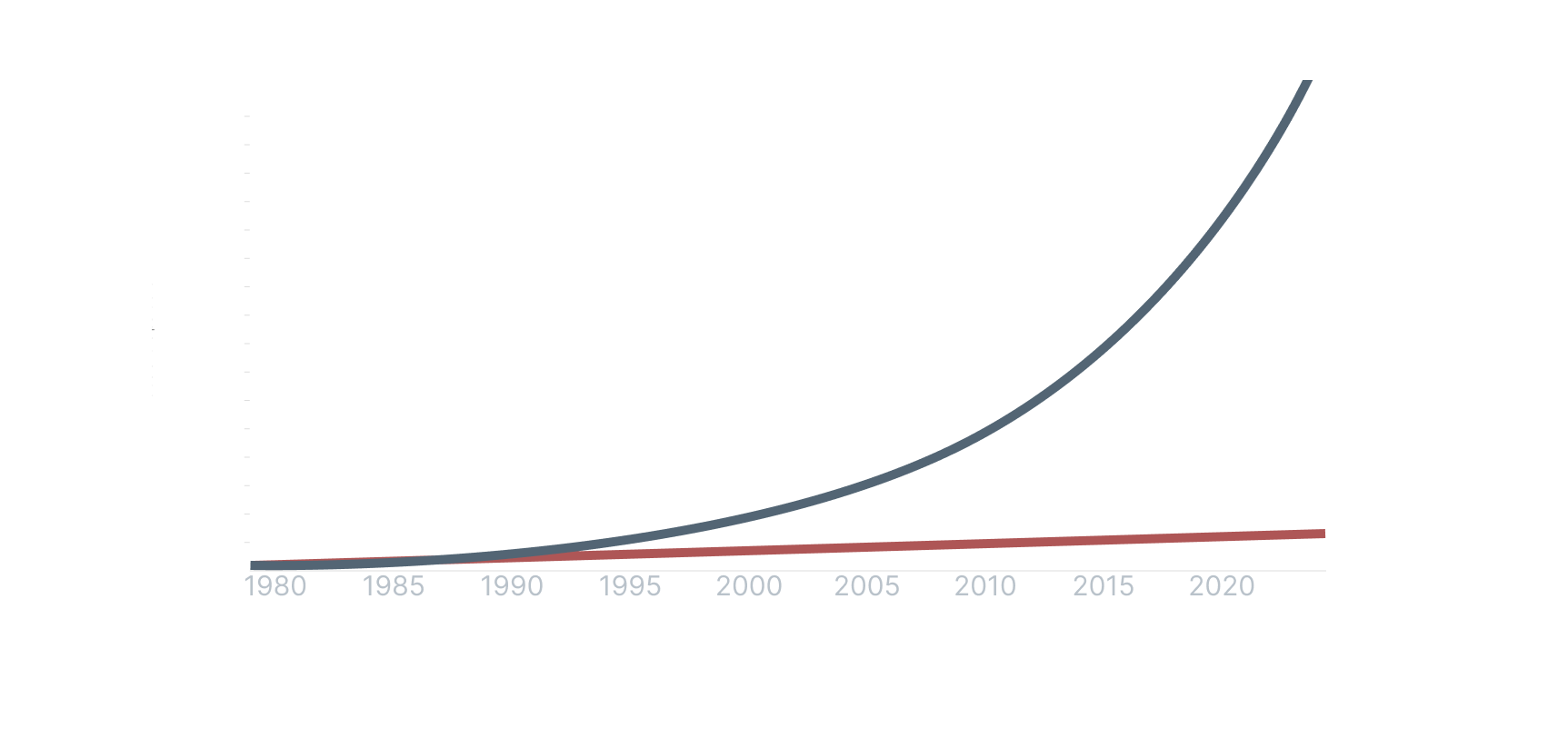

The red line shows Piggy Bank 1. It grows steadily because you're just adding $10 every month.

The dark blue line shows Piggy Bank 2. It grows much faster because, in addition to the $10 you add every month, the interest keeps adding more money.

By 2024, Piggy Bank 2 (dark blue line) has much more money because of the interest—resulting in a total more than 80 thousand dollars. This shows how saving with compound interest helps your money grow much more over a long time! And Piggy Bank 2 is passive investing in the world index. As you can see, investing is a no-brainer.

Continue reading at: How to Start Investing in the World Stock Index ETF

Disclaimer:

This article is intended for informational and educational purposes only. It does not constitute financial advice, a recommendation to buy or sell any securities, or a guarantee of future market performance. The views expressed are solely those of the author, who may also be an investor. Investing in financial markets involves risk, and each reader should make their own decisions independently and, if necessary, consult with a licensed professional.

If you have any thoughts, questions, or feedback, feel free to drop me a message at mail@richardgolian.com.

662

662