Hi, I’m Richard. On this blog I share my thoughts, not investment advice. This is not a recommendation to buy or sell securities.

The Changing Moods of the Stock Market

By Richard Golian28 July 2024 Castellano Slovenčina

It's no secret that the stock market is primarily driven by two sentiments: the fear of evil and hope for good. Within these broad emotions, we encounter speculation on rising share prices and the anticipation of future earnings. Conversely, we also find the fear of falling stock prices, economic crises, recessions, and collapses.

I devoted part of my university studies to understanding moods—what they are and how they change. Therefore, it’s not surprising that this topic also interests me in the context of the stock market.

How I analyze the stock market

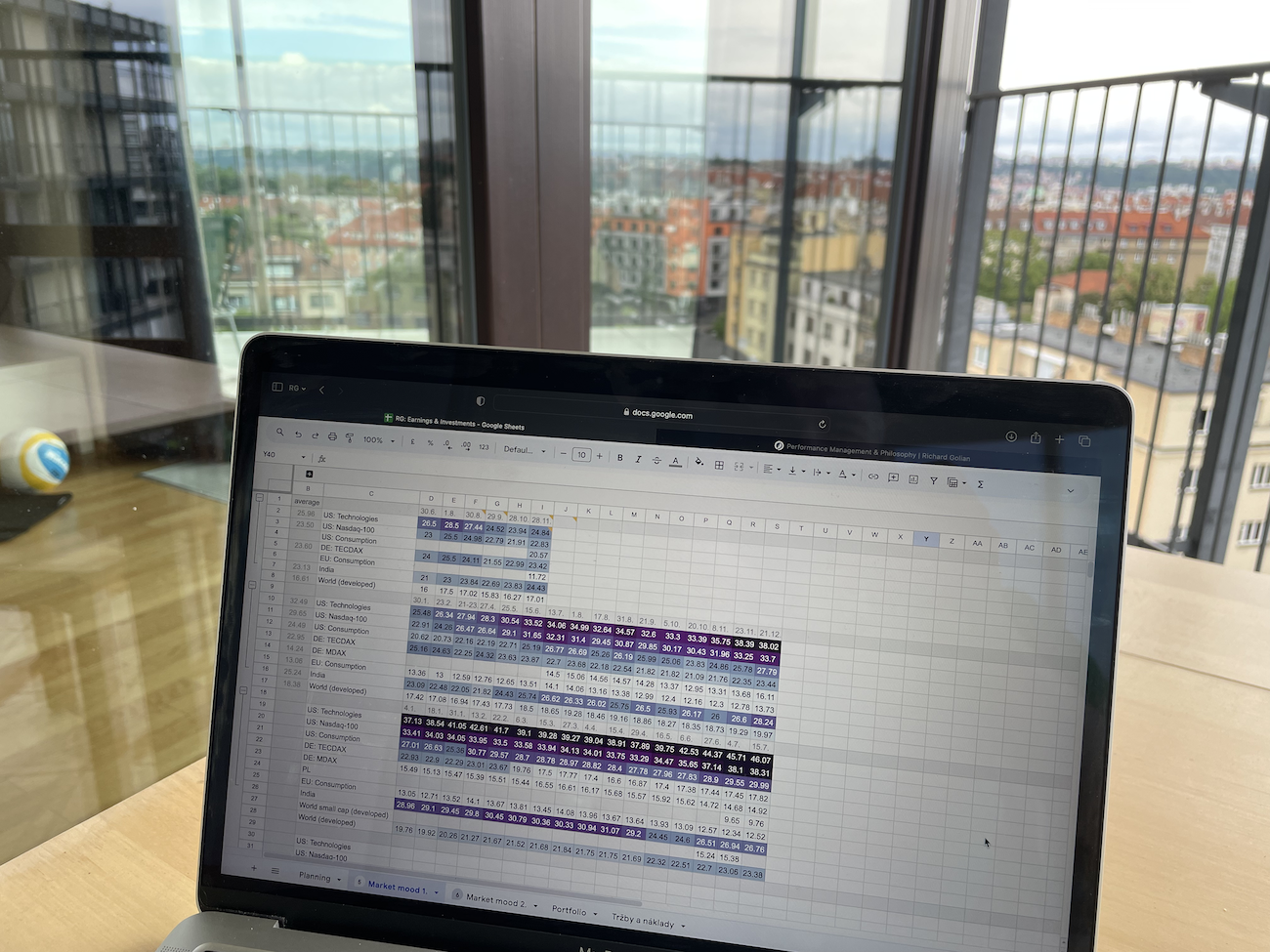

A mood directed towards the future, such as hope for growth or fear of downturns, can be observed through various data. I find it logical to track asset prices within specific segments (geographical or sectoral) in relation to how these segments generate earnings and their value. I compare this data with historical data within the same segment, data from other segments, and the entire stock market's performance.

I use data published by various indexes and ETF funds. As you might gather, I am not analyzing individual shares but collections of shares grouped by specific criteria (read more about stock indexes and ETFs). Since 2022, I have been tracking this data, documenting what the media says about the economy and the stock market, and noting factors that could influence sentiments. This forms my “mood thermometer.”

Continue reading:

Would you like to dive deeper into this topic, see how I think, and have the chance to ask me a follow‑up question? The full version of this post will be sent to your email.

If you have any thoughts, questions, or feedback, feel free to drop me a message at mail@richardgolian.com.

318

318